Perhaps you are familiar with what long term care is, or have a loved one who required assistance. Today there are many ways to help you, and those you care about plan ahead - and be prepared if a need for care arises. Essentially, when you have a plan for care, you can be better equipped to handle the emotional upheaval, physical challenges, and the extensive financial commitment a need for care can require. Today we are living longer than ever before, and the longer we live the greater chance we’ll find ourselves, or those we care about needing care.

Although at LTCi Marketplace we’ve never been a fan of statistic’s, depending upon whose research you review, you’ll find that simply by attaining age 65 there is a 60 to 70% chance you’ll need some sort of care.

Sadly, accident and illness know no boundaries when coming home to roost, and until you are prepared with a plan, the simple truth is you are opting to self-fund these outlays – which can place a lifetime of financial achievement in jeopardy, or future funding needs for retirement at risk. In our eyes, the greatest misconception about long term planning is that it is age based, as opposed to being viewed as a wealth protection tool. What few realize is that of those currently receiving care, nearly 40% are under the age of 65.

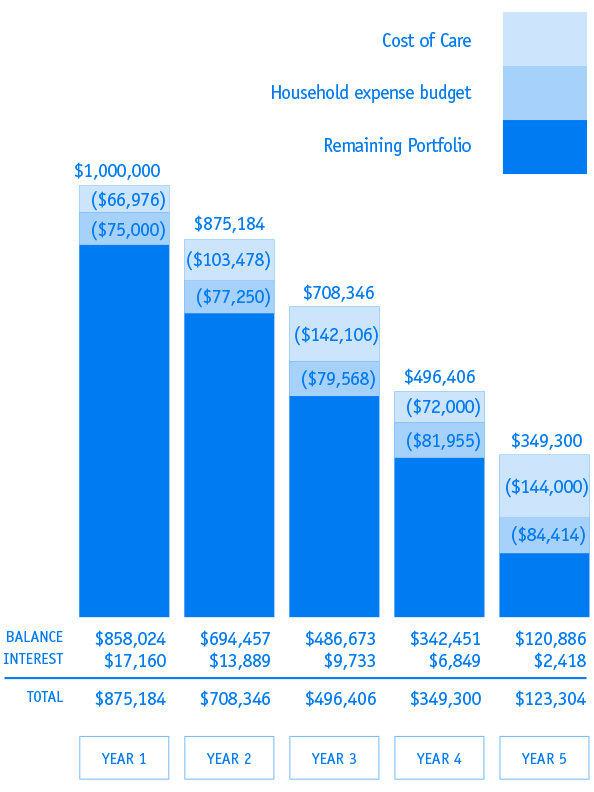

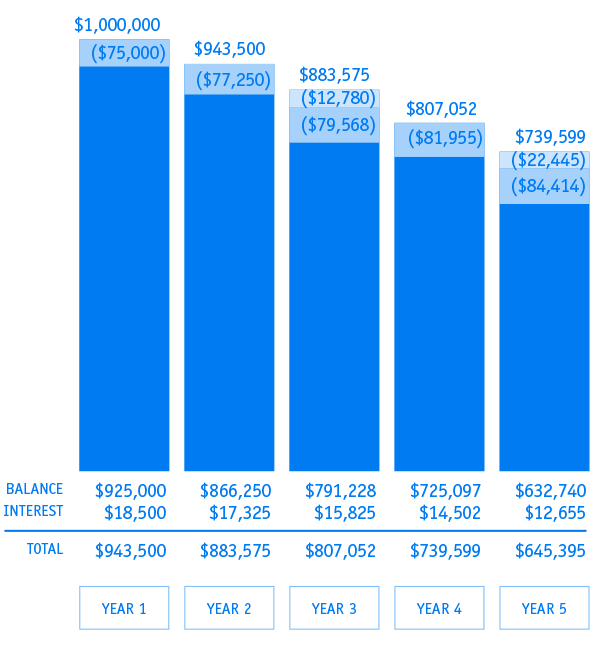

In reality, what is truly the difference between a market downturn of perhaps 20% of an investment portfolio valued at $1,000,000 or spending $200,000 on a need for care? The truth is that should such a scenario occur, those monies removed from an investment portfolio or an IRA, may come with additional tax consequences, and the then the questions must also be asked - “what if such a need came to my doorstep during an economic downturn, and what would this mean to me, or my spouse, or life partner’s lifestyle today or in the future?”

Generally, most all of our clients are glad to self-fund some portion of potential expenses associated with needing care. At LTCi Marketplace, we take great pride in developing plans for care that can ultimately help provide you, and those you care about with greater peace of mind – and are affordable too.

A significant part of our process in designing thoughtful and comprehensive plans, is asking those who come to us for guidance, to have a heartfelt conversation with those they care about, to determine where you or they would like to receive care, be that at home, or in a community or facility that caters to such needs. Further, what amount would be an affordable contribution each month toward your care, if said need lasted four to five years or longer – and where might those monies come from.

Long Term Care – The Pieces Of The Puzzle

Today, there are more options than ever before to plan for care, as companies have stepped to the forefront with new offerings - that can help us to help you design a plan that meets your goals and objectives, and is within your budget. Today you can secure a stand-alone long term care policy, or life insurance that provides access to your death benefit for care prior to passing away, and lets’ you leave any unspent monies to beneficiaries of your choice. These options also include one-time payment plans, or plans that can be paid for over a specified number of years.

Speaking of choices, among these are the length of time you want to receive a monies toward your care, such two years, three years, five years or more. Today, all policies are built around a pool of money to be spent as you see fit, in a care setting of your choice, receiving care by who you want, be that from professional care givers and companions – or in concert with family members.

One other consideration is when do you want your policy to begin paying you a benefit, such as from day one for home care, or other options such as 60 or 90 days from when your need for care begins. The industry refers to this as an elimination period, where you’ll be personally responsible for your cost of care.

Another piece of the puzzle is protecting yourself not just for today, but for care that is hopefully many years down the road. Depending upon your age and needs, we believe having your pool of money grow with some sort of inflation protection is important. This way a $150.00 per day benefit can grow over the next 15 to 20 years to $300.00 per day, or in actuality doubling from $4,500 to $9,000 per month.

Other popular riders include shared care, which allows a spouse or partner to share your pool money should they exhaust their benefit, and this rider also allows the partner or spouse to inherit any unused portion of the other’s policy upon their death. In addition, one can include spousal waiver of premium, so if one of two people is on claim, the other pays no premium until that individual receiving benefits recovers or passes away. Some companies also offer a restoration of benefits rider, which provides that if you were to go on claim and recover, and then not need services for a period of six months, your pool of money restores itself to the original face amount, as if you never received any money from your policy. The last rider I’ll mention, is a survivorship rider, this provides that if a couple were to purchase identical policies, and own them for what is usually a 10 year period without being on claim, when one of the two passes away, the remaining spouse pays no more premiums.

Click here to see a real life example of what the costs of long term care can be.

How Can I Learn More?

We invite you to call or email us, as we welcome being a helpful resource, be that to review existing coverage and policies you may have purchased many years ago – or to explore designing a customized plan that is right for you, based upon what you are trying to achieve.

Although at LTCi Marketplace we’ve never been a fan of statistic’s, depending upon whose research you review, you’ll find that simply by attaining age 65 there is a 60 to 70% chance you’ll need some sort of care.

Sadly, accident and illness know no boundaries when coming home to roost, and until you are prepared with a plan, the simple truth is you are opting to self-fund these outlays – which can place a lifetime of financial achievement in jeopardy, or future funding needs for retirement at risk. In our eyes, the greatest misconception about long term planning is that it is age based, as opposed to being viewed as a wealth protection tool. What few realize is that of those currently receiving care, nearly 40% are under the age of 65.

In reality, what is truly the difference between a market downturn of perhaps 20% of an investment portfolio valued at $1,000,000 or spending $200,000 on a need for care? The truth is that should such a scenario occur, those monies removed from an investment portfolio or an IRA, may come with additional tax consequences, and the then the questions must also be asked - “what if such a need came to my doorstep during an economic downturn, and what would this mean to me, or my spouse, or life partner’s lifestyle today or in the future?”

Generally, most all of our clients are glad to self-fund some portion of potential expenses associated with needing care. At LTCi Marketplace, we take great pride in developing plans for care that can ultimately help provide you, and those you care about with greater peace of mind – and are affordable too.

A significant part of our process in designing thoughtful and comprehensive plans, is asking those who come to us for guidance, to have a heartfelt conversation with those they care about, to determine where you or they would like to receive care, be that at home, or in a community or facility that caters to such needs. Further, what amount would be an affordable contribution each month toward your care, if said need lasted four to five years or longer – and where might those monies come from.

Long Term Care – The Pieces Of The Puzzle

Today, there are more options than ever before to plan for care, as companies have stepped to the forefront with new offerings - that can help us to help you design a plan that meets your goals and objectives, and is within your budget. Today you can secure a stand-alone long term care policy, or life insurance that provides access to your death benefit for care prior to passing away, and lets’ you leave any unspent monies to beneficiaries of your choice. These options also include one-time payment plans, or plans that can be paid for over a specified number of years.

Speaking of choices, among these are the length of time you want to receive a monies toward your care, such two years, three years, five years or more. Today, all policies are built around a pool of money to be spent as you see fit, in a care setting of your choice, receiving care by who you want, be that from professional care givers and companions – or in concert with family members.

One other consideration is when do you want your policy to begin paying you a benefit, such as from day one for home care, or other options such as 60 or 90 days from when your need for care begins. The industry refers to this as an elimination period, where you’ll be personally responsible for your cost of care.

Another piece of the puzzle is protecting yourself not just for today, but for care that is hopefully many years down the road. Depending upon your age and needs, we believe having your pool of money grow with some sort of inflation protection is important. This way a $150.00 per day benefit can grow over the next 15 to 20 years to $300.00 per day, or in actuality doubling from $4,500 to $9,000 per month.

Other popular riders include shared care, which allows a spouse or partner to share your pool money should they exhaust their benefit, and this rider also allows the partner or spouse to inherit any unused portion of the other’s policy upon their death. In addition, one can include spousal waiver of premium, so if one of two people is on claim, the other pays no premium until that individual receiving benefits recovers or passes away. Some companies also offer a restoration of benefits rider, which provides that if you were to go on claim and recover, and then not need services for a period of six months, your pool of money restores itself to the original face amount, as if you never received any money from your policy. The last rider I’ll mention, is a survivorship rider, this provides that if a couple were to purchase identical policies, and own them for what is usually a 10 year period without being on claim, when one of the two passes away, the remaining spouse pays no more premiums.

Click here to see a real life example of what the costs of long term care can be.

How Can I Learn More?

We invite you to call or email us, as we welcome being a helpful resource, be that to review existing coverage and policies you may have purchased many years ago – or to explore designing a customized plan that is right for you, based upon what you are trying to achieve.